Hawaii paycheck calculator

Single filers and married people filing separately pay rates ranging from 140 on their first 2400 of taxable income up to 1100 on income over 200000. This Hawaii hourly paycheck calculator is perfect for those who are paid on an hourly basis.

6000 App Icons Hawaii Summer Mint Pastel Light Teal Etsy In 2022 App Icon Tinder Messages Android Widgets

Your employees estimated paycheck will be 70372.

. Take a Guided Tour. But dont forget the fact that you can always use Zrivos Hawaii Paycheck Calculator to save your time and find accurate outcomes. The results are broken up into three sections.

You can use this calculator to determine your pre-tax earnings at an hourly wage-earning job in Hawaii. Hawaii Hourly Paycheck and Payroll Calculator. The Hawaii Salary Calculator is a good calculator for calculating your total salary deductions each year this includes Federal Income Tax Rates and Thresholds in 2022 and Hawaii State Income Tax Rates and Thresholds in 2022.

Need help calculating paychecks. From 262500 to 300000. Our paycheck calculator will convert your hourly wage to weekly monthly or annual earnings.

This tool has been available since 2006 and is visited by over 12000 unique visitors daily and has been utilized for numerous purposes. Below are your Hawaii salary paycheck results. From 225000 to 262500.

Switch to Hawaii salary calculator. Use ADPs Hawaii Paycheck Calculator to estimate net or take home pay for either hourly or salaried employees. First put in your hourly wage.

00 hours 725. Calculate your Hawaii net pay or take home pay by entering your per-period or annual salary along with the pertinent federal state and local W4 information into this free Hawaii paycheck calculator. The regular hours of work during this pay period will also be 50.

Hawaii State Unemployment Insurance SUI As an employer in Hawaii you have to pay unemployment insurance to the state. Details of the personal income tax rates used in the 2022 Hawaii State Calculator are published below the calculator. Just enter the wages tax withholdings and other information required below and our tool will take care of the rest.

This calculator can determine overtime wages as well as calculate the total earnings for tipped employees. Paycheck Results is your gross pay and specific deductions from your paycheck Net Pay is your take-home pay and Calculation Based On is the information entered into the calculator. For example if an employee receives 500 in take-home pay this calculator can be used to calculate the gross amount that must be used when calculating payroll taxes.

The calculator on this page is provided through the ADP. Use this Hawaii gross pay calculator to gross up wages based on net pay. Hawaii SUI rates range from.

Switch to Hawaii hourly calculator. Hawaii Salary Paycheck Calculator. Lets say your hourly wage is 2000.

Important note on the salary paycheck calculator. Paycors Tech Saves Time. Hawaii Hourly Paycheck Calculator.

All Services Backed by Tax Guarantee. How to use this Hawaii paycheck calculator. Simply enter their federal and state W-4 information as well as their pay rate deductions and benefits and well crunch the.

Both a state standard deduction and a personal exemption exist and vary depending on your filing status. Use SmartAssets paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal state and local taxes. Lets go through your gross salary in further depth.

00 hours 725. Hawaii also has a small disability insurance tax as well which has a maximum cap on the applicable income. Overview of Federal Taxes When your employer calculates your take-home pay they will withhold money for federal and state income taxes and two federal programs.

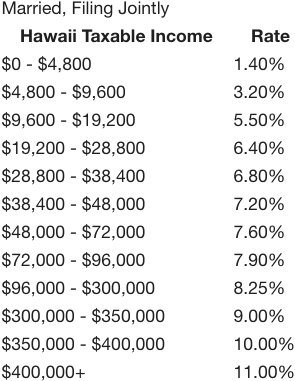

Hawaii Employment Training Fund assessmentinterest payment. Residents of the Aloha State face 12 total tax brackets and rates that are based on their income level. This Hawaii bonus pay aggregate calculator uses your last paycheck amount to determine and apply the correct withholding rates to special wage payments such as bonuses.

This Hawaii Paycheck Calculator helps you to translate your hourly wage to earnings per week month or year. No personal information is collected. It determines the amount of gross wages before taxes and deductions that are.

Calculating paychecks and need some help. Well do the math for youall you need to do is enter the applicable information on salary federal and state W-4s deductions and benefits. 02 to 58 for 2022.

The 2022 tax rates range from 02 to 58 on the first 500 in wages paid to each employee in a calendar year. Ad Payroll So Easy You Can Set It Up Run It Yourself. Our paycheck calculator is a free on-line service and is available to everyone.

Use Gustos hourly paycheck calculator to determine withholdings and calculate take-home pay for your hourly employees in Hawaii. Use Gustos salary paycheck calculator to determine withholdings and calculate take-home pay for your salaried employees in Hawaii. Take home pay is calculated based on up to six different hourly pay rates that you enter along with the pertinent federal state and local W4 information.

Second put in the number of work hours per week. Ad The Best HR Payroll Partner For Medium and Small Businesses. The tax rates are the same for couples.

Your results have expired. Our Expertise Helps You Make a Difference. If youre a new employer congratulations you pay a flat rate of 3.

In addition you are responsible for.

Using Guard And Reserve Retirement Calculators To Estimate A Reserve Pension Retirement Calculator Retirement Guard

Qube Masters Financial Education Financial Literacy Financial

Cost Of Living In Hawaii In 2020 The Ultimate Guide To The Price Of Paradise

Find Out What Your Trees Are Doing For You And Our Planet Calculate Here With National Tree Benefit Calculator Climate Zones North America Map America Map

Biweekly Mortgage Payments Vs Monthly Why You Should Consider Making Extra Payments On Your Mortgage Mortgage Payment Mortgage Loan Calculator Mortgage Loans

How To Calculate Real Estate Taxes On Your Property Estate Tax Property Tax Real Estate

Balance Sheet Income Statement Financial Etsy Income Statement Balance Sheet Financial Statement

Insurance Home Car Health Business Marketplace Health Insurance Infographic Health Health Business

Party Planner Contract Template New Party Planner Contract Template Google Search Event Planning Contract Party Planner Template Event Planning Quotes

Printable Mortgage Calculator In Microsoft Excel Mortgage Loan Calculator Mortgage Amortization Calculator Refinancing Mortgage

Hawaii Paycheck Calculator Smartasset

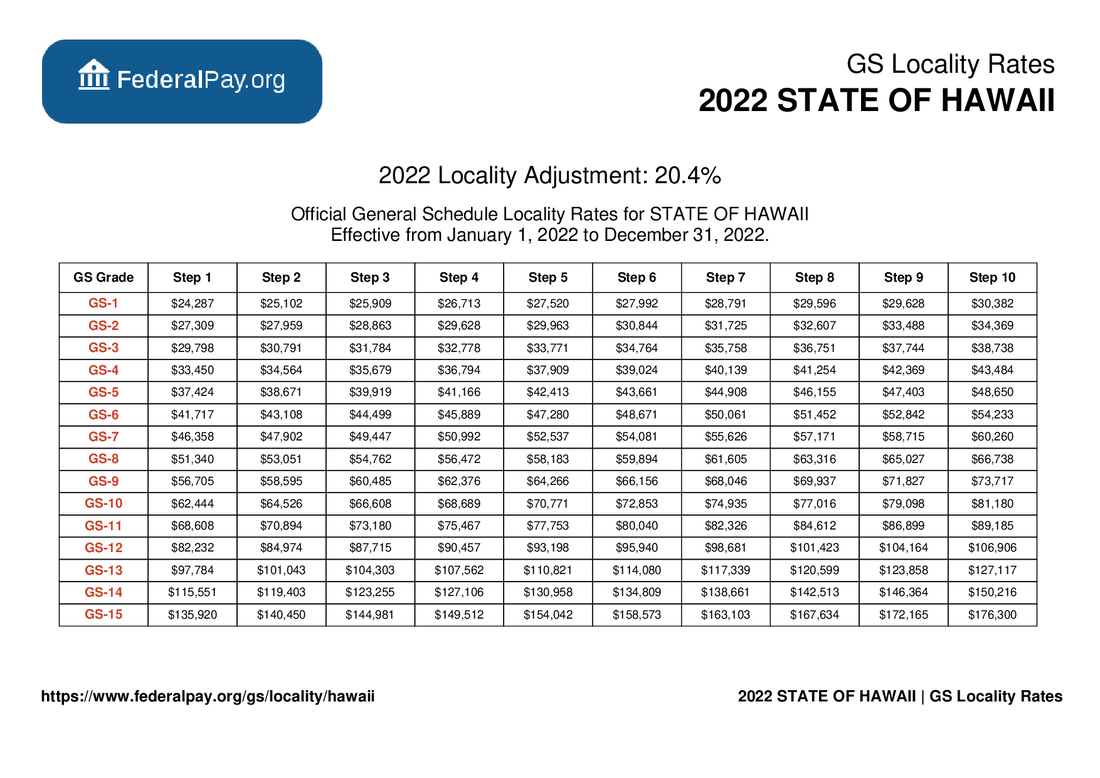

Hawaii Pay Locality General Schedule Pay Areas

Hawaii Paycheck Calculator Adp

4 Steps To Be More Financially Conscious This Year Hawaii Home Remodeling Debt Collection Managing Your Money Consumer Debt

Hawaii Paycheck Calculator Smartasset

Pin By Melanie Rodrigo On Games Luau Bridal Shower Aloha Bridal Shower Hawaiian Bridal Shower

Hawaii Paycheck Calculator Adp